Natural Gas

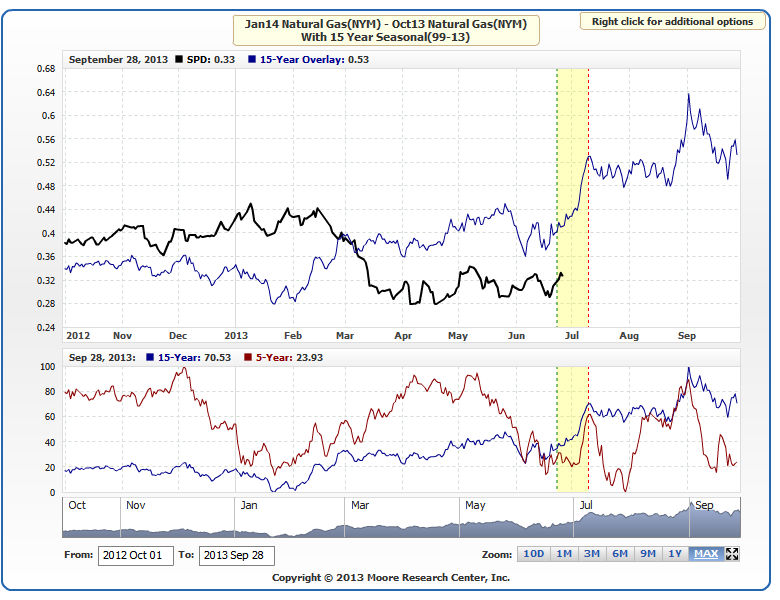

I've been keeping an eye on this one for a while now. NG remains bearish in my opinion with continued injections into storage and no cooling related demand on the immediate horizon.

There are a few good NG spreads to watch with most running until mid July.

Wheat - Corn

This is a short little pattern, which might actually be a little too short for my liking but it's one to keep an eye on as it gets nearer.

Kansas Wheat - Soybeans

Again another short term one which I don't overally like. Just keeping an eye on it for now. These inter-market spreads can also be rather volatile at times.

Corn

We saw a somewhat bearhish WASDE report yesterday and that might help this spread. While it's a little early there seems to be a nice support level where we're currently at and a good solid seasonal window.

With the delayed plantings catching up over the last couple of weeks, hopefully corn is back on track, however some doubt still remains around potential yield losses and what the final acreage is going to look like.

Live Cattle - Lean Hogs

I like the look of this one in terms of the really solid seasonal window. There is a nice support level here that we are currently at based on the 15-yr average also.

However I'm still a little worried about betting against Hogs. They have been super strong of recent times against a backdrop of talk of buying from China and the recent Smithfields takeover.

That said there is also talk of Hogs getting toward the top of their run. Something to consider.